When it comes to achieving financial independence, there’s no one right path. In fact, there are many different ways to get there. However, if you want to have the biggest impact on your journey, you should focus on these three main levers:

- earn more, spend less

- save, invest more, buy assets

- return on investments and time

Each one of these levers can have a major impact on your journey and ability to achieve financial independence.

So don’t underestimate their importance!

Before we get started exploring the three levers in more detail, remember one thing:

Money is not the captain of this journey — you are!

Learn how to steer through life using three main levers and you’ll be well on your way to reaching your goals!

Let’s dive in!

Lever 1: Earn More, Spend Less

This is the most fundamental lever of them all.

It’s pretty self-explanatory, but it’s important to remember that earning more and spending less should be done in balance. If you focus solely on one or the other, there won’t be much progress made towards financial independence.

There’s one key takeaway here:

- your saving potential is limited, you can’t save more than what you earn

- your earning potential is unlimited, there’s no upper cap on how much you can earn

Start by analyzing your current income and expenses, then decide which actions will have the greatest impact on your ability to reach financial freedom.

In the short term cutting your expenses will have the fastest effect.

While cutting back on unnecessary expenses, taking advantage of tax deductions and credits, and so forth are all nice and helpful, there’s nothing better than to tackle the so-called “Big 3” — housing, transportation and food. All three combined can easily add up to 50% of your total expenses — so you’ll want to pay close attention to them!

Over the medium to long run, you should look into boosting your income.

You do this by improving your skills and value by taking on more responsibility at work and getting a raise, by increasing your investment income, through a side hustle, or by building a business, the possibilities are endless!

The goal is to widen the gap between income and expenses as much as possible!

The wider the gap, the more free cash flow to “fund your dreams” you will have.

This is the rocket fuel to defy financial gravity and reach your financial goals faster!

Lever 2: Save and Invest More

The second lever is about what you do with your free cash flow.

If you’re saving and investing more money, you can build an asset base and reach your financial freedom faster!

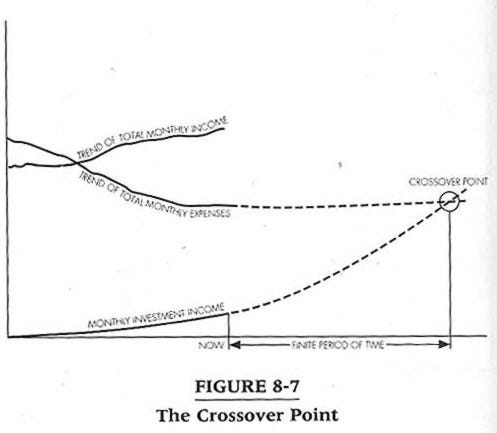

See how reaching the so-called “crossover point” will make you financially free:

A well-structured portfolio of appreciating assets is the foundation of your financial freedom, and you need to start investing early if you want to achieve it sooner rather than later.

The key here is “investing for the long term”. It may sound cliche, but it’s true — don’t try to time the market, don’t try to “get rich quick — but stay poor” — instead, focus on building a diversified portfolio of long-term investments and let the power of compounding interest work its magic.

The best way to trick yourself into this is to pay yourself first.

What does that mean?

It means to make sure you set aside a portion of your income into investments each month. Try setting up automatic contributions to your investment accounts from each paycheck. This way it won’t be up to your monthly discretion or feelings to decide how much to save but your contributions to your dreams would be based on the fixed amount you decided on in advance:

The moment your salary hits your account, you pay yourself first.

Nothing beats automation in achieving financial independence.

Set it and forget it!

Lastly, track your “savings rate”, the percentage of your income you can save every month. Find ways to push it higher and your “FIRE battery” will get charged faster.

Lever 3: Return on Investments and Time

The third lever is about using time in your favor and getting the most out of your investments.

Become a good investor and invest in assets that will perform and appreciate over time and make sure you understand how your investments are performing.

Having a good return on your investments is a key lever to achieving financial independence — after all, it’s not just about saving money but also making that money work for you and building an asset base.

In addition to focusing on returns, pay attention to time!

Time is the greatest asset you have when striving for financial independence, and it should always be factored in when making investment decisions! Remember, even at age 65 you might still have an investment horizon of 30 years these days. Be prepared for this.

Compounding/ compounding interest is the “eighth wonder of the world” as Einstein said, and you should use it to your advantage!

The earlier you start with investing, the heavier the workload your assets may take-over!

Do you have time or does time have you?

Best is to make time!

Don’t Forget: You are the Captain of this Journey!

Financial independence is an achievable goal and the three levers we discussed today will help you get there faster.

You don’t need to be perfect or follow a set path — it’s all about being disciplined, consistent and making smart decisions that are tailored to your individual needs, goals and resources.

Money is not the captain of your journey, you are!

Whether it’s through income maximization, spending minimization, smart investing, or all three of them together combined with enough time — focusing on these three levers will help you reach financial independence faster!

Remember that there is no single “right” way for achieving financial independence as everyone has a different situation and set of goals.

Find a path that works for you!

Be profitable,

Matt

Wait a second!

If you liked this post, please help me paying it forward by sharing it with your family and friends and don’t forget to subscribe to Financial Imagineer via email in the box below, give me a follow on Twitter and/ or Facebook. NEW: For a daily dose of “finspiration” you can now also join me here on Medium where I write every day. I’d appreciate it a lot.

If you’re looking to get your money skills “up to speed”, check out my online course or feel free to book 30-minute consultation with me via Zoom.