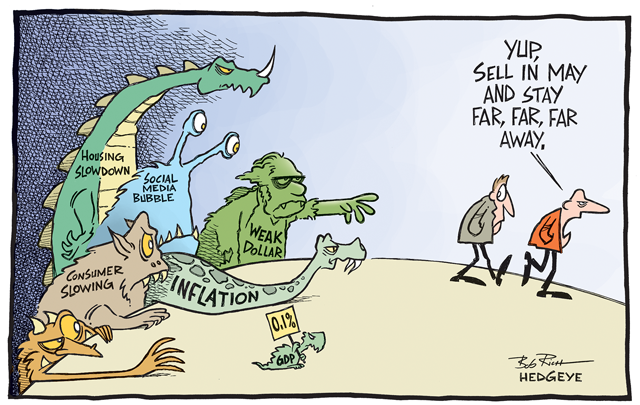

Every year, by late April articles are written about why you should sell [your equities] in May and go away as the lower volume summer months are coming. You got to remember to come back in November though!

This sounds so easy. And hey, it even rhymes!

But does this work?

What is behind this myth?

Can you time the market like this?

Seasonality exists in stock markets. It has been traced back hundreds of years. However, timing the market is difficult and you can lose out big – by NOT participating. 2020 was such a particular year where you would have lost out big time if not invested during summer!

Over a longer timeframe, stock market performance was generally better during winter as compared to summer months. The interesting point however is, it wasn’t “perfect” or consistent enough to time and actually capitalize by following the simple rule “sell in May and go away” – so don’t be fooled into believing this blindly!

This May, I wanted to know it for mysef, let’s see what I’ve learned about this myth.

Is it a wise saying or nothing else than folksy nonsense fluff?

I talked with Yasi of Fast Track about this very topic as well today right here:

Market Seasonality

If we think of seasons and holidays in the Western world, Christmas and New Year play a large role. That’s also when usually most money is spent and made. Just think of holiday shopping and year end bonuses being paid out. On the other side, trading volume during summer months is lower and there’s more volatility.

Stock markets and market sentiment are driven by these considerations and patterns, which form the seasonality in the investing space. “Sell in May” is not the only one, you might have heard of other seasonal market effects like “the Santa Claus Rally”, “tax loss harvesting season”, the “January effect” and many more such as “day and night effect”. While each market seasonality has a different reason that may sound highly plausible, markets don’t usually perform according to them.

The overall statistic looks very tempting. If you look back till 1945, the SP500 performed only an average of 1.4% during the summer months which is much lower than the annualized index performance. However, even during summer, the index was up in 63% of all years observed. This is still better than low or no returns as with holding cash.

A look back at a long-term perspective (overlapping decades) shows that in recent history there was no single year where stocks were consistently better during summer than winter months! For example 1990 to 1999, 2009 to 2018 all had periods where it would have been more profitable to sell in May and go away for sure – but they did not last throughout their whole respective time period like people might think from reading articles about this myth without understanding the bigger picture. You would have to hit the nail on its head to actually profit from it.

Furthermore you could actually lose out big if you blindly followed the advice as sometimes. The market is generally more active in the summer than during winter – as it has been for decades, but that doesn’t mean you should sell your equities in May and go away!

2020 was one example where you lost big if you wouldn’t participate.

What Does Science Say?

Ben Jacobsen and Sven Bouman have written a paper called “The Halloween Indicator, ´Sell in May and Go Away´: Another Puzzle [link here] in which they document the existence of a strong seasonal effect in stock returns based on the popular saying. Surprisingly this inherited wisdom was found to be true in 36 of the 37 developed and emerging markets studied in their samples. It tends to be particularly strong in European countries and is robust over time. The UK even has a notable effect since 1694.

The scientists have examined a number of possible explanations and concluded none of them appeared to be able to convincingly explain the puzzle.

Why People Love This Saying so Much?

Without any offense, hell, the saying is neat, it rhymes and you can even extend it with a second part “…but remember to come back in September (or November)”!

Who could ever forget such a saying?

It’s so simple!

Humans like easy explanations for stock market movements and are constantly looking out for patterns such as seasonality. If there’s a lazy way to do something smart, you win many folks over. Just have everyone believe there are less opportunities to make money during summer and they are happy following the advice.

Yes, investing is simple… but not easy it seems.

The stock market is a device for transferring money from the impatient to the patient.

Warren Buffett

While there is certain evidence supporting and explaining seasonality, there’s no bullet proof way to outperform in the long term due to this.

So if you’re going to buy stocks for some reason or another, don’t believe what people tell you!

My advice: Be especially wary if the advice rhymes.

Conclusion

Seasonal patterns in asset prices are not a new phenomenon, it has been studied for over 200 years and seasonality is as old as market activity itself. The idea behind this fabrication comes from anecdotal evidence: there’s an increased amount of low volume trading during summer months which is true but misleading because it doesn’t indicate any meaningful change to long-term performance – your broker just isn’t active anymore!

What these journalists don’t say is that stocks still have positive return most summers (although less than winter). If you’re going to sell anyway, do so based on fundamentals rather than level of volatility or time of year.

The best way to build wealth with the stock market is to stay invested.

Time in the market will be rewarded higher than timing the market.

“We continue to make more money when snoring than when active.”

Warren Buffett

To get access to more blogposts, insights and other resources on investing please subscribe by email below, follow on Facebook, Twitter, or reach out directly here for more.

Stay the course!

Matt