What would you do if you received a $ 1 million jackpot? How does it actually feel to receive a windfall? What to do with it and how could it impact your life in the short, medium and long run?

Let’s first think about what you could possibly do with a large financial windfall?

– splurge (Sir? The Lamborghini in same gold as the Maybach?)

– take a sabbatical and travel to exotic locations, sipping martinis all day long

– travel to Vegas (all or nothing)

– re-invest in lottery tickets

– buy a house and/or pay-off your mortgage

– invest all into Vanguard ETFs and draw an annual $40,000 forever (Trinity study, 4% withdrawal rate)

– keep calm and carry on

Here’s what a Financial Imagineer would do with a $ 1 million windfall:

Keep calm and carry on!

Keep calm and carry on!

You find this hard to believe?

Looking through all the above options, this clearly appears to be the most boring choice. But hey, I’ve got a rather personal story for you guys today. Let me explain.

Once upon a time, I won a windfall myself.

I wanted to be a Millionaire.

We write the year 2001, my most crazy side-hustling days: During daytime, I was usually studying business administration and economics. Frequently, after sundown, you’d find me baking up to 200 pizzas each night at the first pizza home delivery franchise in my hometown. Saturdays, you’d find me advising clients at a bank counter and Sundays I’d be running the local polling station in our village.

Some wondered if I’d ever catch some sleep.

One evening, I was sitting on our couch watching the Swiss edition of “Who wants to be a Millionaire” on TV3. Somehow, none of the contestants ever seemed to make it past the first 10 questions. It got boring and frustrating. It quickly became painful for me to keep watching. I knew and appreciated the show from abroad and generally liked it because you usually learnt something while watching – infotainment. The entertainment value of the local version was rock-bottom. This tickled a nerve.

Instead of applying the ordinary way, I sent a feedback letter asking them to invite more suitable candidates in order to improve the infotainment value of their show. Little did I know that my written rant would be read and acted upon. Before I knew it, we – my then girlfriend and myself – got invited to participate as contestants at the TV show “Who Wants to Be a Millionaire”.

Turn sound on, click “play” and listen as you read on!

We spent the two weeks prior to the recording with extensive preparations. Since nobody could every finish reading Wikipedia (back then it was the Microsoft Encyclopaedia on CD Roms), we started feeding our brains with compressed wisdom using books like “The Knowledge Book: Everything You Need to Know to Get by in the 21st Century”. We also played the computer game of “Who Wants to Be a Millionaire” over and over again in order to get into shape and learn how we’d react if under pressure and what mistakes to avoid.

Ready Player One

Two weeks later it was showtime.

We entered the TV studio. The recording started. Game on. First question. Bam, I got on the hot seat. From there, everything went incredibly fast. And after less then 2 hours in the TV studio I was fortunate enough to have won a large windfall for the first time in my life.

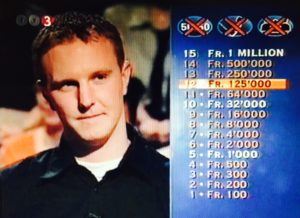

How much did we win?

Actual screenshot from Swiss TV3 (2001)

We cleared about $125,000.

I was young, 21 years young to be exact, ran out of all three jokers and decided to call it a day. It felt surreal.

A short moment later they ripped the cables and microphones off me. There are still some blurred memories of me having shaken the show masters’ hand. My knees were soft, somehow it felt like flying on cloud number 9 to the back of the stage.

All of a sudden somebody tipped my shoulder, they pulled me back to reality.

A pen was handed to me and I was asked to clear the paper work in legalese. I signed. Sign-off here, sign-off there. Besides confirming how much we’ve won, the TV station asked me to also sign a non-disclosure agreement: We were not allowed to reveal the outcome of the show to ANYONE until the show was aired. It took another two weeks until my episode was on TV.

We went home.

Stealth wealth mode.

Swiss banking secrecy.

I knew the drill.

The Aftermath

In hindsight, this was probably the most awkward AND best situation I could ever have asked for. It was stealth-wealth practice. Maybe you have also read articles about how most lottery winners can’t handle a windfall and end up broke. I had time – time to think about how to win at life – despite having won a small fortune.

Here I was. Glowing in the inside. Ice cold on the outside. Poker face. Not allowed to talk about my experience of just having won a windfall. Pretending nothing has happened and going back to my normal busy life.

Some of my friends and colleagues knew that I participated on the show. Of course they asked all kind of questions. I played along and didn’t bother to talk too much about the show anymore for two weeks. I was back to “business as usual mode” and kept hustling. Literally the very next day, I was baking 200 pizzas again as if nothing happened. Many assumed that the show didn’t work out for me. At all.

Two weeks later, the TV show finally aired.

As the news spread, some colleagues wondered why I still show up at work and continue to bake pizzas until midnight, continue to advise banking clients on Saturdays and still rely on public transportation instead of buying a car.

What does a 21 year old do with a six-figure bank account?

First thing: I went to the ATM and printed an account statement for the record.

Nice, but now what?

The Splurge

It was a real honor for me as a young BA and Economics student to invite our family and selected friends for a restaurant celebration meal with drinks. Thereafter, we also splurged about $500 for a short break to sunny Spain, paid our taxes (ouch) and most importantly invested ALL the remaining into boring mutual funds.

That’s it.

Nothing else.

About two months later, we were back to normal and carried on with our lives.

Did my life change at all after that event?

Hell yeah it did!

Not immediately, but slowly.

The Transformation

Having had the extra cash aside, I slowly realized how much power came with it. Power over your own time and life. While most of my university classmates couldn’t wait to have their employment papers signed, I was dreaming to learn more, explore and discover the world.

Explore, Dream, Discover

With a fresh Masters Degree in my pocket, I took off on a 3 months backpacker trip to Central America. Learning Spanish, exploring a foreign culture and another way of life was extremely refreshing and eye-opening.

On my trip, I passed through New York, Toronto, then Bocas Del Torro in Panama, Turrialba in Costa Rica and many other exciting places. The scuba-dive course was $200. Spanish lessons came at $15 half a day including free coffee and internet. A night in a hostel was $7. Arroz con pollo $2 and cerveza for $1. The ultimate luxury dish, fresh caught lobster, butterfly style, set me back $5. Beautiful.

Bocas del Torro, Panama, watertaxi to Red Frog Beach (2003)

Conclusion: I learned a new language. Price tag: $3,000 and 3 months of my time.

It came with fun, adventure, new friendships and unforgettable memories. Actually, back in high school I sucked at learning languages! Now, without the pressure, I was enjoying it! Muchas gracias!

On the flight back home I got sad that this “graduation trip” is over. Then it dawned on me: While I was away, my investments more than fully covered for the trip already. Passively.

Bazinga!

“If you don’t know where you are going, you might wind up someplace else.”

– Yogi Berra

This experience taught me that I enjoy getting lost in other cultures, eating stuff I’ve never tried before and exploring how other people live on this planet. My logical conclusion therefore was to double dare myself and set an even more ambitious target: learning Chinese. In early 2004 I left home again. This time to live and work in Taiwan, thanks to AIESEC.

I stayed in Taiwan for almost three years, worked for three different companies, learned Mandarin Chinese, and got to know my future wife. A whole new world opened itself: The Chinese hemisphere with all its opportunities.

Badaling, the Great Wall of China (2005)

In 2007 we – my beautiful, loving wife and I – returned to Switzerland. To say the least, the newly acquired Mandarin Chinese language skills and the cross-cultural awareness opened the door to a promising job covering Chinese speaking clients.

“Time is more valuable than money. You can always get more money, but you cannot get more time.”

– Jim Rohn

Don’t just invest your money, make sure that you also invest your time.

6 Life-Winning-Lessons

1) Keep Calm and Carry On.

If you win the jackpot, receive a windfall or get a huge inheritance: Keep calm and carry on. Circuit-break your natural busyness and stop the rat-race for a moment. Don’t adjust your lifestyle right away. You got all the time in the world to adapt slowly. Invest into buying time!

Make it a blessing, not a curse.

2) Take a Break and Celebrate Your Windfall.

Commemorate your big moment. Spend something but don’t splurge.

“The more you praise and celebrate your life, the more there is in life to celebrate.”

– Oprah Winfrey

3) Dream and Plan for the Long Term. Imagineer your life!

How many people have the opportunity to do this in life? How could such a windfall help you learn new skills, grow and have fun at the same time? Having/ taking time to reflect about life is extremely valuable. We all have different dreams. What is yours?

“A human being always acts, feels and performs in accordance with what he imagines to be true about himself and his environment. For imagination sets the goal ‘picture’ which out automatic mechanism works on. We act, or fail to act, not because of ‘will’, as is so commonly believes, but because of imagination.”

– Maxwell Maltz

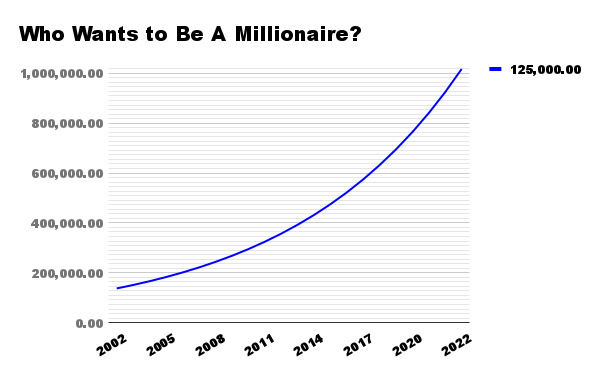

4) Invest the Money and let Compounding do its Magic.

Imagine $125,000 invested in equities, growing at an annualized 10% for 20 years: $125,000 could have grown into $1 million by itself by late 2021!

How to become a Millionaire if you didn’t win the full million at the show?

“The stock market is designed to transfer money from the Active to the Patient.”

– Warren Buffett

Become a successful navigator of the seven capitalistic seas!

Use a GPS and/or read up if needed.

5) Do a Real World MBA

In 2016 Tim Ferriss’ published his book “Tools of Titans”. One chapter is called “How to create a Real-World MBA”. His idea is quite straightforward: Instead of spending a fortune and a couple of months of your lifetime on a MBA and simply “learning” theoretical stuff in classrooms from reputable PhD theoreticians and professors who use big words and fancy powerpoint slides but never left their campus themselves, you might as well use the same amount of money and start-up a company or create even better and more exciting learning and growing opportunities. Apparently exposing yourself to real-world experiments and experiences shapes you stronger than learning theoretical stuff from books alone. “Tools of Titans”. Great read.

From 2001 onwards I’ve bought time and invested in improving skills of all kind on an ongoing basis. This has not only kept my life interesting and adventurous but also brought me financial returns and lasting contentment later in life.

6) Give back

You can give back and share in many ways. Some people prefer to give money through donations or on a one-off basis. Others prefer to directly share their time and experience. This could be done through volunteering, mentoring/coaching or even with a blog. Ever since my windfall, I’ve done all of the before mentioned. It feels good if you can support and help others!

We make a living by what we get, but we make a life by what we give.

– Winston Churchill

Final Conclusion:

If you are lucky enough to win a windfall: Keep calm and carry on. Celebrate, but don’t splurge. You may not be able to stop time, but you can stop the rat-race and “buy” time. Dream and imagineer your future. Invest in your skills, your passion, life quality, memories and fun. Why? Because it will shape you and your loved ones in ways you could never have imagine before. Dreams are everything – technique can be learnt.

“You cannot advance if you cannot visualize the end from the start.”

– Nabil N. Jamal

What’s your dream? What’s your perfect life? Imagine the perfect day, all the people you’d like to see and have fun with, the passions you’d like to chase as well as all the places you’d like to go. What’s your dream and how do you plan to get there? Writing down your dreams is the first step!

Inspire all of us by leaving a comment below or on Twitter and Facebook.

Sweet dreams!

Financial Imagineer

Disclaimer:

This blog doesn’t finance itself, please be made aware that the product links used above are affiliate links for which Financial Imagineer might receive a compensation.

Wow, I really enjoyed reading this. Smart money move of you to invest most of it! I also loved that chapter in Tim Ferriss’ book.

Happy you enjoyed the read. The longer I think about FI and investing – it all seems to boil down to “time is money” but also “money is time”. How to strike a balance and take advantage of the two will determine how happy we can become. Cheers!

Awesome post and great advice! I think it’s wonderful that you both treated yourself and invested.

Thanks, hope my experience and shared advice can help readers making decisions and taking actions to lead a richer, happier life.

Really enjoyed reading this. I’m glad you had the smarts to cram before you went in to record the episode, and then had the brains to invest it. That money has set you up in life – good job!

Thanks so much Frogdancer! The opportunity to participate in the show might just have been a once-in-a-lifetime chance. Crucial to cram and very happy that I did. Thanks!

“Buying time”… love the concept. That is what financial freedom is all about, having enough to support the luxury of choosing how we invest our precious time.

Great article, and congratulations on getting most of the questions right on the tv show. I bet it is harder than it looks, in front of a crowd with the bright lights on you.

The conclusion after deep reflection was:

Wealth won’t create success, the freedom to make it will. Watching the show from the comfort of your couch vs. actually sitting on the chair myself was rather different indeed. However, with all the lights aiming at you, you won’t even notice the crowd anymore and it’s mostly you talking with the showmaster.

Great experience! It’s like playing the lottery and the worst outcome is that you’d go home empty-handed. Cheerio!

Congrats on your win and thanks for sharing. I love stories like these…

I really enjoy the Real Life MBA concept from Tim Ferris’ book. That is something I’m trying to do in my personal life – figure things out on the entrepreneurial side and grow that way!

Happy Friday!

Thanks for stopping by. Even though it’s been 17 years already, my memories are still rather fresh and after almost two decades since the event, it’s interesting to ask yourself how this windfall might have shaped my life. Just checked out your website, lots of great stuff there! Cool stuff!!! Happy Friday as well Sir.

I really enjoyed this article. Very very responsible behaviour for a 21 year-old.

Thanks for your comment Barbara, in hindsight: Happy it turned out this way ;o)

This post is spot on! You are right, there are so many stories of people winning money and then blowing it all on silly things!

I had a similar experience when I sold my company. I took off on a two week trip to Sri Lanka with my family, but when I got back I returned to work the next day. I paid off some debt and invested what remained. This was two years ago and we still drive the same cars and life has not changed 🙂

Dream on!

Great, avoiding lifestyle creep is the most simple action of the many to start buying freedom and accumulate wealth! Earning, saving and investing more will be the natural results over the course of life. Dream on indeed and keep spreading the FIRE!

Congratulations on the sale of your company; that’s a really great approach! Visit family, then go back to work (hopefully doing something you enjoy).

Great read! Thank you for sharing! Back in HK sometime?

Dear Peter, thanks for your comment – will keep you posted once next trip to HK is planned. Cheers!

Really enjoyed this post. Congrats on your win. My windfall was no where near as big as yours but was still significant for me. About two years ago I received an unexpected inheritance from an aunt. Added to money I had received from my parents’ estate the year before it equaled more than 2.5 years of my annual salary. Except for about $2K (used to pay debt) it has been invested. Now I admit I am not in a position to go jetting off to foreign countries but have never felt such stress relief ever in my life. Even this small windfall has made a huge difference in my life. We are in much better position financially and improving.

Dear Suzie, thanks for stopping by and leaving a comment. Stress relief is priceless! I think it’s not about how much the windfall is but more about what you can do with it in order to improve your quality of life. By not consuming but rather investing it you can enjoy this advantage for a lifetime! Congrats!!!

#5 is something I never heard of! It’s essentially what I’ve been trying to do myself for some time. I could go back to school or I can let life school me.

Really great article! This was a fun one to read.

I really loved the graphics, and the chart of $125,000 growing over the course of time. There is nothing more powerful in finance than compound interest!

Pingback: Millionaire Interview #7 - Financial Imagineer