There’s no time like the present to create wealth. Most wealthy people know that it’s during difficult times when possibilities for building wealth abound. So if you’re looking to create some serious financial stability for yourself and your loved ones, don’t wait – don’t let this crisis go to waste – start now. Learn how to create wealth during a recession with the following 8 tips.

1. Never let a Crisis go to Waste.

When it comes to creating wealth, there’s no such thing as a bad time – only good opportunities disguised as bad times. So instead of being afraid of a recession, use it as an opportunity to create wealth. Change your goggles, instead of using your fear glasses, look for opportunities!

Adapt your mindset, and understand Mad Wallstreet.

2. Get Creative with Your Investments

Wealth creation is all about thinking outside the box. If you want to create wealth during a recession, you have to be creative and think differently than “the rest of us“.

But don’t worry, there are plenty of ways to create wealth without putting your life savings at risk. For example, you could start a business or invest in real estate, another way is by investing in distressed assets. This could be anything from a house that’s in foreclosure to a business that’s about to go bankrupt. Of course, you need to be careful with these kinds of investments, but if you do your homework, you could see some serious opportunities during a recession.

You can also get creative with more traditional investments, like stocks and bonds. For example, you could invest in companies that are doing well despite the recession. The high percentage of passive investing results in more generic sell-offs of everything and stock pickers might find stocks at undeservedly low levels.

Another option is to start your own business. Many people lose their jobs during a recession, but if you have an entrepreneurial spirit, this could be the perfect time to turn your ideas into reality and pivor into a new life altogether. There are many resources available to help you get started, so there’s no excuse not to at least try.

What’s the worst that could happen?

3. Take Risks

Be willing to take risks when others don’t dare to. This doesn’t mean that you should invest all of your savings in a high-risk venture and eventually lose everything – but it does mean that you should be open to new opportunities and try something new every once in a while. If you’re creative, you can find ways to make money even when times are tough.

Of course, you need to be careful with your risks. Make sure that you have a solid plan and that you’re investing in something that you understand. But don’t let the fear of losing money or failing hold you back from making money or trying something new.

When was the last time you did something for the first time?

Investing in the stock market has always been volatile and volatility goes both ways.

Maybe the riskiest thing you could do during a recession is NOT to take any risks?

4. Control Your Fears

One of the biggest obstacles to wealth creation is fear. When times are tough, it’s natural to feel afraid. But if you want to create wealth, you have to be willing to take risks. So instead of letting your fears control you, take charge and make decisions that will help you create wealth.

Reminder: Everything you want is on the other side of fear!

Fear of failure, fear of success, fear of the unknown – all of these things can hold us back from achieving our goals. If you want to create wealth, you need to learn how to control your fears.

Start by identifying your fears.

What is it that’s holding you back?

Once you know what your fears are, you can start to work on overcoming them.

Remember, no one ever accomplished anything great by playing it a 100% super-safe.

As an investor, you need to control your emotions, stay disciplined, and stick to your investment plan.

Don’t sell when the markets are down.

Focus on what you can control: Discipline and self-control are key!

5. Over Time, Markets Always Go Up

During a recession, it may feel like the end of the world. The stock market is crashing, jobs are being lost, and businesses are shutting down. Especially in such moments, it’s important to take a step back and change your perspective.

Remember that over time, markets always tend to go up. So if you’re patient and invest during a recession, you will eventually be able to buy at discounts and see your investment grow faster.

The market WILL recover. But not every Investor will.

Difficult environments are often where the best opportunities can be found.

Take comfort from the past, economic downturns never last forever.

6. Buy More Assets at Cheaper Prices

This is the most universal, simple, and basic advice I got in this article: If you are young and in your wealth-building stage, a recession is a great opportunity for you to build more wealth faster. Dollar-cost average your way through a recession and embrace the discounts.

Think of the stock market as a supermarket. Stocks – as opposed to our finite time in this life – are nonperishable goods. Buy as many as you can whenever offered at a discount.

If you’re building wealth regularly: Do NOT pause your contributions! Stick with your plan.

As mentioned above, this is simple but essential advice. Taking advantage of cheap stocks or any other assets does not just apply to people still being able to add more money into assets. If you’re beyond this stage though, and also if not, the next paragraph is for you!

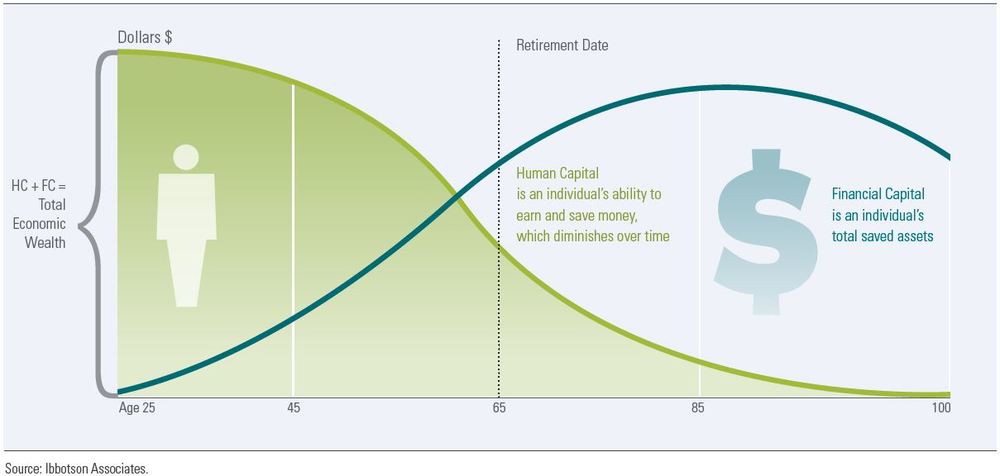

7. Activate Your Assets and Rebalance

If you’re somewhat older or retired already, you might be saying: “Matt, I’m fully invested already. The markets crashing hurts me, I can’t just keep buying more dips all the time.” I hear and understand you!

If you’re fully invested it’s time to think about rebalancing and activating assets!

Rebalancing is the process of resetting your asset allocation. For example, if you have a portfolio that’s 60% stocks and 40% bonds, during a recession the stocks dropping faster than the bonds may lead to a 50-50 allocation. To get back to your 60-40 portfolio, sell some bonds and add more to your stock holdings at cheaper prices now. Do the same after strong bull runs and you’ll always be buying cheap and selling expensive.

In a recession, it’s all about reallocating, restructuring, and renegotiating.

Some might also consider changing their strategy at a certain point.

But don’t stop there. If you have other assets – like a house, for example – or idle assets not working for you – think about how you can use them to create even more wealth.

Make a list of all your assets and see how hard they’re working on making you wealthier. If they don’t work hard enough, make them work harder for you! Make them sweat!

Read here how to Get your assets off their asses!

8. Start Now

The sooner you start creating wealth, the better off you’ll be. So don’t wait “for better times” – start now! The sooner you get started, the more time you’ll have to create a sizable fortune.

Creating wealth during a recession is not only possible, but it’s one of the best times to do it. So if you’re ready to create some financial stability for yourself and your loved ones, don’t wait – start now!

Ready Player One?

Conclusion

Remember, even though a recession is a difficult time for many people, it’s also an opportunity to create wealth. If you’re looking to create wealth during a recession, don’t let your fears hold you back. Take some risks, be creative, activate your assets and never let a good crisis go to waste. With a little bit of effort, you can take advantage of a recession and create the financial stability and dream life you’ve always wanted.

What are you waiting for?

How do you build wealth during a recession? Let me know in the comments below!

If you have any questions about inflation, investing, financial independence, [early] retirement, or life in general, consider booking a free consulting call with me right here.

Stay tuned for more financial literacy, imagineering and finspiration:

Consider subscribing to my blog in the box below, give me a follow on Twitter, like my Facebook page and feel free to check out more content here.

Get started today and financially imagineer your dream life!

Matt